A very important step towards financial independence is an emergency fund. It can be hard to take this step when you’re living paycheck to paycheck, but it’s such a relief to have that safety net. Eventually, you’re living paycheck to paycheck with a couple thousand of backup dollars which is a very different experience. There are no hard and fast rules to get there, but here are some guidelines.

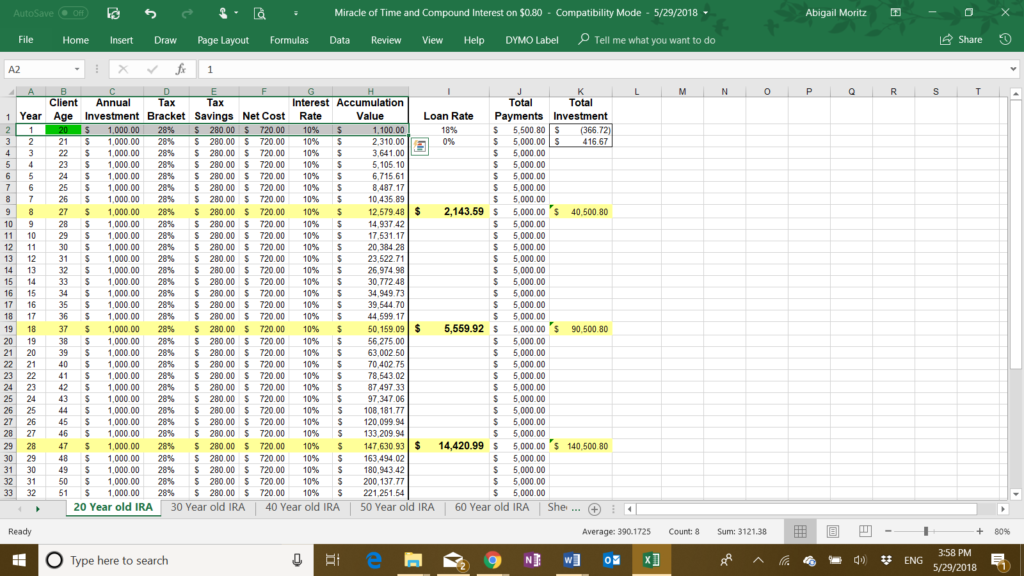

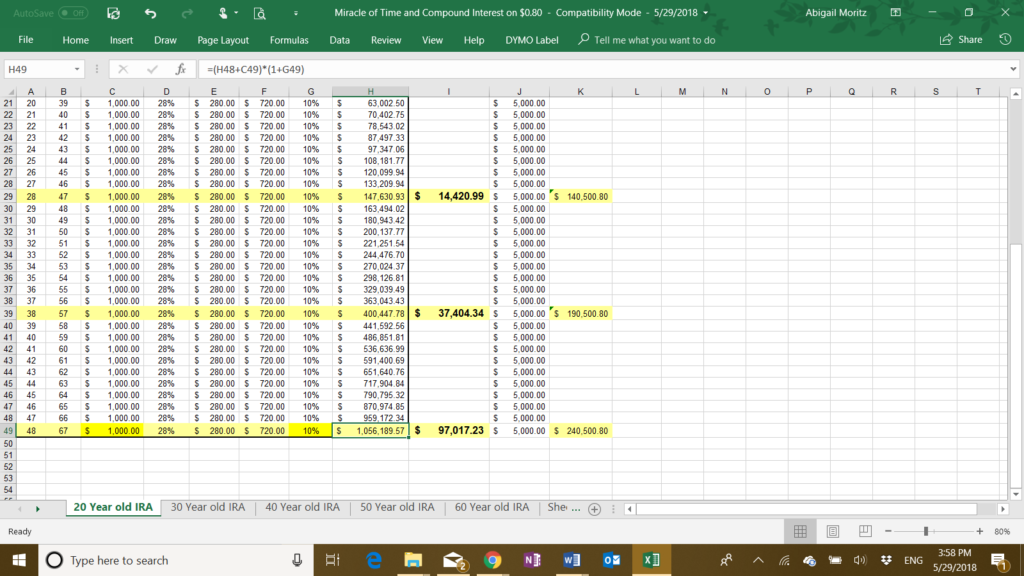

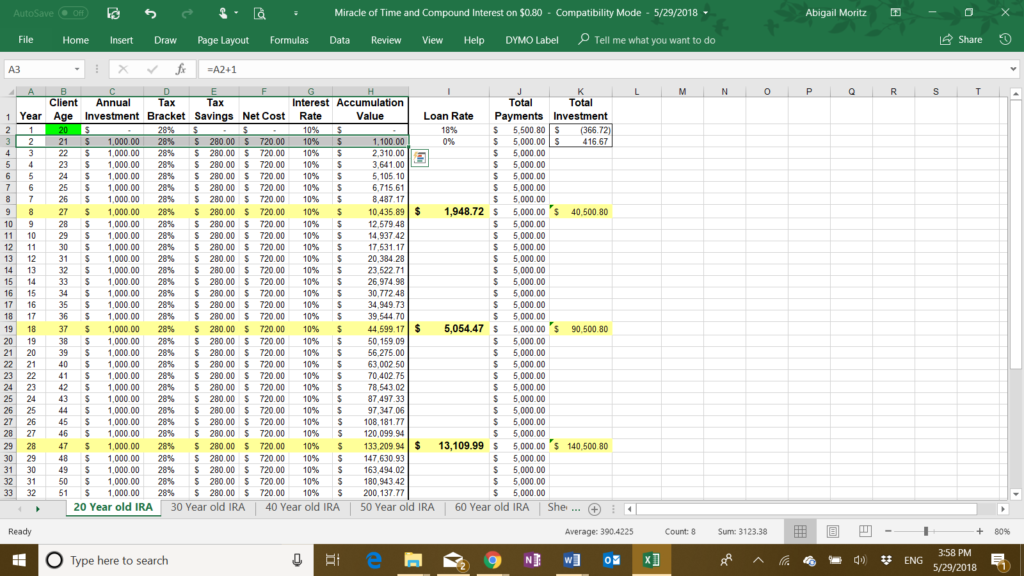

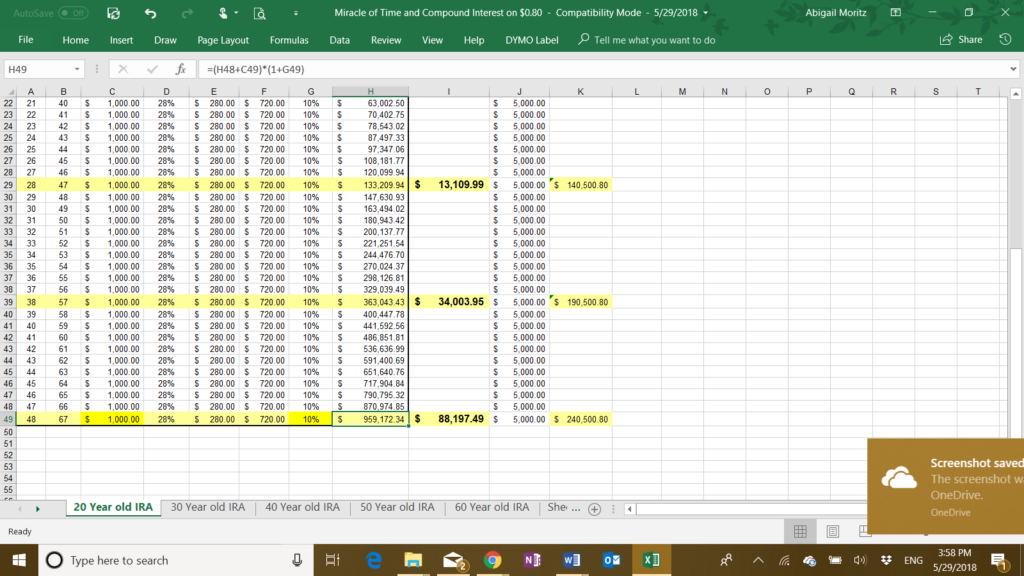

First, lets start by talking about priorities. You will never achieve financial freedom without first evaluating your priorities. We’ve talked before about using Credit Cards to your advantage, paying off Student Loans and other debts, and about Planning for Retirement. All of these things are important and could rank higher in your priorities than an emergency fund. I would recommend prioritizing keeping your credit card debt at zero and paying off your loans aggressively. However, planning for retirement and emergencies are both forms of planning for the future and you may find a balance between them as priorities. Of course, required bills like rent, utilities, food, etc. have to be top priority, but you must be careful to differentiate between needs and wants. It is hard when you’re just starting out to live below your means and resist temptation. It is important though so you can build up funds for a rainy day.

Second, you need to commit to treating your Emergency Fund like an Emergency Fund. Basically, once you put money in, you are not allowed to take any money out for any reason. Now, I’m clearly exaggerating slightly, but I choose to think of my Emergency Fund as untouchable money. That way I truly only use it for emergencies. I haven’t needed to touch it even when I had periods between jobs. I would find other ways to afford my bills first. If it comes down to not paying a bill or incurring debt, then its time to tap into your emergency fund as needed. Adjust this mentality to what works for you.

Ok now that you have evaluated your priorities, let’s get to it. It may be difficult to know where to start. Let’s break it down into goals.

Goal #1: Aim to have $1,000 in your account.

It may not seem like much, but it is an achievable goal. You will also be relieved to have it if you ever need it. If you do have to use it for an emergency, make sure to prioritize restarting your goal. While you have achieved goal number 1, don’t stop contributing to your account. Then you’ll be on your way towards achieving goal number 2.

Goal #2: Aim to have the amount equal to 6 months of expenses.

This is an ultimate goal so if you need to make another smaller goal between the 1st and 2nd goal, then go right ahead. These are guidelines so adjust them to what works for you, but don’t give up. To achieve this goal, you need to sit down and evaluate your finances again. Hopefully, you have a budget in place that you’ve been using for a while. That information will make this step much easier. Be honest with yourself and don’t try to undercut your number. If you ever need to rely on this money, you will be glad you funded it properly.

First, take your housing cost, high average of your utilities, your cellphone and Wi-Fi bills, enough for refills on fuel, groceries, and required monthly payment for your loans plus the amount you have chosen to avalanche your bill like we discussed in our Student Loan Repayment article. Once you have added all these up and double checked that you haven’t forgotten a monthly expense, you will multiply it by 6 so that you then have the amount of 6 months expenses and your goal amount. I would recommend rounding up to the next round number. That way you have a little wiggle room and its easier to remember. Again, if you ever use any of the money from your Emergency Fund for an emergency, then you should restart when you can until you hit your goal again.

Once you have hit your goal, forget about it like I said before. Using your Emergency Fund should be strictly an absolute last resort. You can have another saving fund for things like new phones, cars, and other wants. After you hit your emergency fund goal, you can give more focus to other goals like retirement and paying down debt.

Benefits of a High Yield Savings Account

Something I wish I had known about years ago is a High Yield Savings account. Until last year, I had just been using the Savings Account and Money Market Account that came with my Checking Account. This was fine because it helped me sort my funds into an “untouchable account”. The Savings Account was fine for this purpose, but it only gained $0.01 in interest which doesn’t even keep up with inflation. Last year I discovered High Yield Savings that have interest returns close to 5%! This is a game changer. Once you begin your Emergency Fund, it will grow in small ways on its own. Imagine that! It is like a little reward and helping hand for taking the right step.

I personally use the CIT Bank, but there are lots of options. I saw that Credit Karma from Intuit has one, and there are plenty of others. Just make sure that you are clear on the minimum required deposit and if there are any fees for having the account or for inactivity. You should be aware that some accounts will offer $0 fees only for the first year so make sure that you only get one that stays free indefinitely. Depending on where you are in your journey you may also need to choose one with a lower deposit requirement. Make sure that the deposit minimum to receive the desired interest rate is also within your means. You’ll also want to make sure that the bank is FDIC insured and trustworthy. Do your research!

To give you an idea of what this could do for you, I’ll give you my personal example. As I mentioned before, my old account only gained about $0.01-0.03 per month so the only growth it saw was what I deposited into it. Once I discovered the HYS account, I already had my 6 months of expenses ready to deposit. For me, that was $12,000. With that money deposited in a HYS, I started earning around $34 per month! Then that $34 was added to the amount gaining interest so now I was earning $50 because of the compound interest. A year later, I have $800 more dollars than I deposited and I’m earning around $52 in interest payments each month. I didn’t even make any additional contributions and I have seen that much growth! It really is amazing, and I recommend starting one as soon as you can. I wish I had started one 10 years ago. Imagine where I’d be now.

A few additional thoughts to help you get started:

- Set up a split direct deposit to automatically deposit a set amount into your emergency fund instead of having it all go to your checking account from your paycheck. That way you never get the opportunity to spend it in the first place.

- Make as many smaller goals as you need. If positive checkpoints encourages you, then feel free to add more goals between $1,000 and 6 months. You could do $1,000, $5,000, $10,000, and 6 months or whatever you need. As long as you’re making progress, that’s the real goal.

- Feel free to go beyond 6 months savings if you feel you need to. Most of the advice I’ve heard is after you have 6 months saved, you should focus those funds and attention to paying off debt or funding your retirement account. With that in mind, I wouldn’t recommend worrying about more than 1 year’s worth of expenses before switching your focus. Personally, I refocused after funding 6 months expenses.

- 6 months of expenses will change with time. Reevaluate yearly or whenever you have a major life change to make sure you still have enough to cover your current value of 6 months expenses. Moving cities, buying a house, adding a member to your family – all of these things will change how much you need saved to be able to cover 6 months expenses. Inflation will also change your total. Has your cell phone or rent increased from last year? Reevaluate regularly to avoid being underfunded.

I wish you the best of luck as you embark on the next step to financial freedom. I’m not a financial professional, but this is what has worked for me. Always make sure to consult a professional before making any major financial decisions. Remember, there are no rules, just guidelines!