You may be thinking “I’m in my twenties, I don’t need to worry about retirement yet”. You may think that retirement is more of a thing you do in your thirties, but actually getting started as early as possible can have a huge payout later on.

Did you know that to retire, someone our age needs to have more than $1 million saved up? It’s ok. You can panic for 30 seconds.

Ok panic is over. Now I’m going to help you get there.

Why You Should Start Early

The first and most important, yet intimating part is you must start saving. Even if you are only setting money aside for now that’s a start. Yay! That was pretty easy. But that is only a temporary solution. You want to get your money into an investment ASAP.

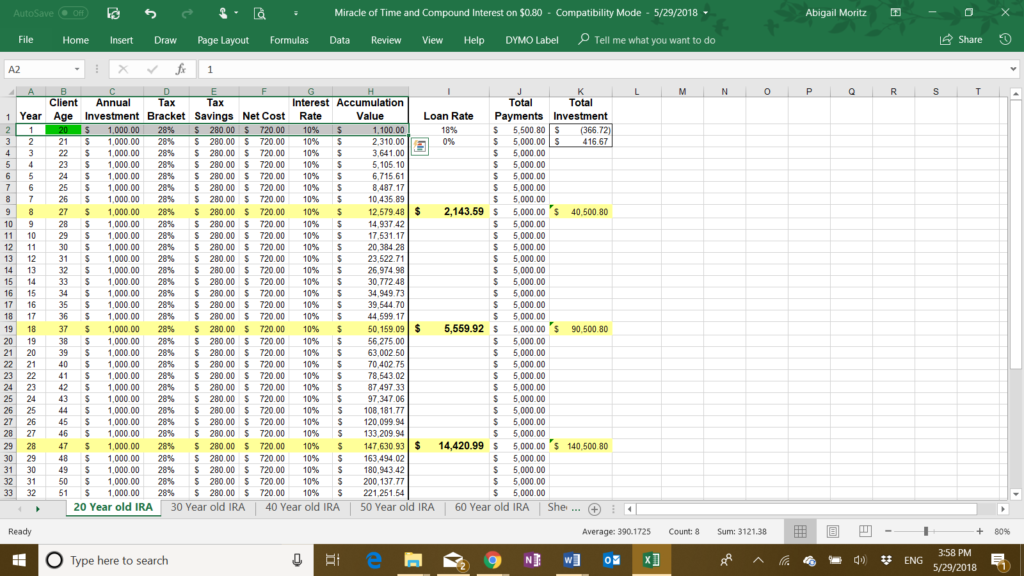

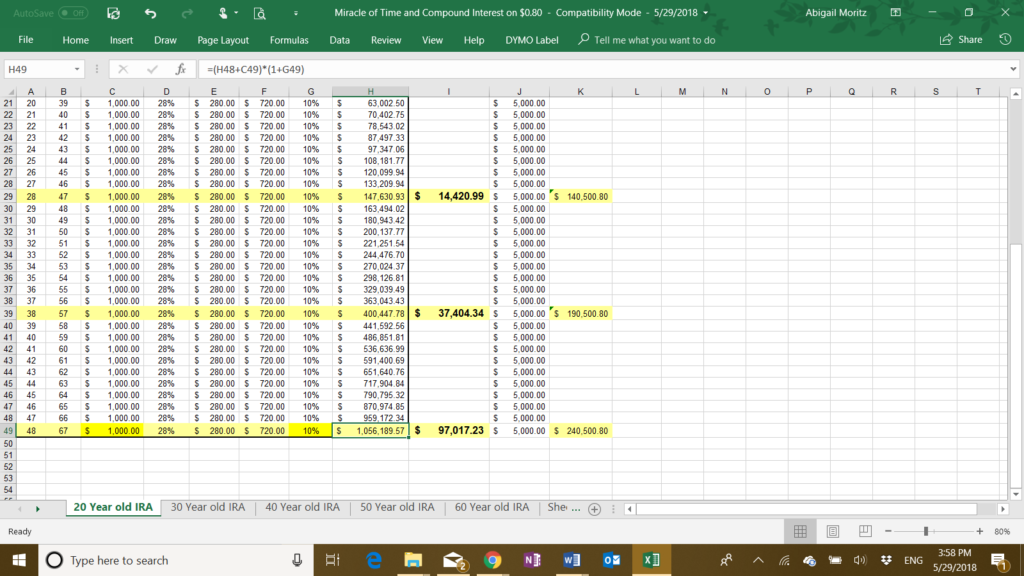

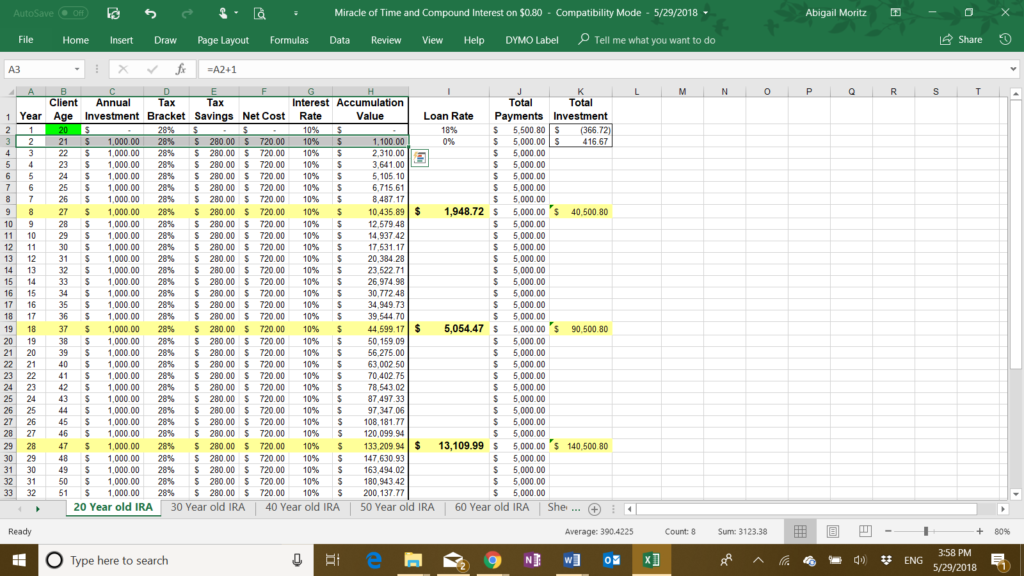

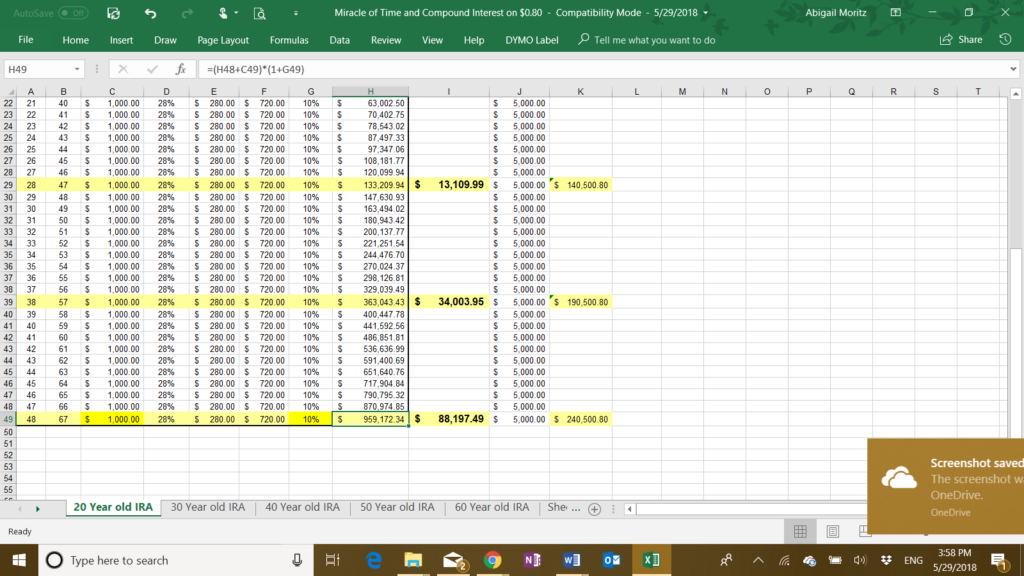

Even beginning investing 1 year earlier can change the final payout by a surprising amount. It’s hard to imagine yourself, but luckily I have a cool little tool that can show you the difference investing early can make. Check it out here to help gain the motivation to start. I received this tool from Robert Moritz, a certified financial planner, and I’m sharing it with you with his permission. He actually helped me set up my Roth IRA so I would definitely recommend looking him up if you’re in one of the states he services (IN, OH, AL, CA, FL, GA, IO, KY, PA, SC, WV).

According to this simulation, investing $1,000 every year starting at age 20, this person had $1,056,189 in accumulated value by only 48.

On the other hand though, when they waited to start investing until 21, they only had $959,172 in accumulated value by 48. That is almost $100,000 in lost savings.

Now you see why it’s so important to start investing as soon as you can and as much as you can.

Feel free to play with your own numbers and ages.

Types of Retirement Funds

Two common choices for investing include 401 K and IRAs.

A 401k is usually done through your place of employment as a benefit of working for them. Companies will often offer a “401k match”. Which simply means that whatever you contribute to your 401k retirement fund, the company will also put in a certain amount. You should make it a priority to meet the maximum amount the company will match because that’s just free money. However, don’t limit yourself just to the maximum match amount. If you can, always put in as much as your budget allows.

The simplest way to describe an IRA is it’s a retirement fund for people who don’t have a 401k offered through their work. This will often happen if you work for a small organization, you’re a freelancer, or if you only work part-time. A certified financial planner can help you decide if a regular IRA or a Roth IRA is better. Basically the difference is when the government taxes the money. For myself, I went with a Roth IRA based on my advisors advice. However when I changed jobs, my advisor thought moving my 401k from the old job into a traditional IRA would be most beneficial.

Each of these accounts has a legal maximum you are allowed to contribute each year. This is just another reason you should begin investing early. You won’t be able to make up for it later as easily due to the yearly contribution limits. As of 2021 tax year, the IRA contribution limit is $6,000 for a single person ($12,000 for a couple).

Something very important to remember about retirement funds: you can not take any money out of this account after you put it in until you qualify for retirement. If you take it out early, you will incur some major penalties that will make it not even worth taking the money out. So while you should always put in as much as you can, don’t put in any money that you will need back before you’re 60. This is not the place to save for a car or a house. Keep a savings account you can access for those and for emergency funds.

Remember, a little is better than nothing. Nothing with compounded interest is still nothing. Speak to your financial advisor to find a plan that works for you and your goals.

These are more like guidelines anyway.

*I am not a financial expert nor should this advice be considered legal advice. You should always listen to a certified financial planner before me.